Bank Holidays In Netherlands 2023 ODINT Consulting

For income up to €73,031, the rate is 36.93%. For income above that amount, the top rate is 49.50%. Holiday pay is a form of income paid in addition to the regular salary. Therefore, it is subject to the highest applicable tax rate for the employee. So, if an employee has a taxable income of €75,000, their holiday pay falls into the high.

Holiday allowance in the Netherlands YouTube

Holiday allowance (in Dutch) must be at least 8% of the employee's gross wage of the previous year. This includes overtime, performance premiums, any commissions, supplements for working unsocial hours and payment in lieu of holiday days. Holiday allowance is not due over expenses, bonuses, or profit distribution.

Holiday allowance in the Netherlands Expatax

Holiday allowance in the Netherlands. Holiday allowance in the Netherlands is a gross payment of 8% of your total gross salary. This amount is usually built up during your employment period in the months June to May. Employers are obligated to pay this 8% holiday allowance to their employees. The Dutch word for holiday allowance is.

Holiday allowance in the Netherlands Expatax

The Netherlands Labour Authority can impose fines on employers who underpay their employees. The level of the fine depends on the extent to which the wages vary from the statutory minimum wage and the statutory minimum holiday allowance. The maximum fines are: EUR 2,000 per underpaid employee (in case of payment under the minimum holiday.

What is Holiday Allowance (Vakantiegeld) in the Netherlands? Blue Lynx

Holiday allowance in the Netherlands. Holiday allowance in the Netherlands ("vakentiegel") is a gross payment of 8% of your total gross salary. Although employers are obliged to pay this 8% holiday allowance to their staff, it is up to them whether to pay it all at once in may or spread it over 12 months instead.

Public Holidays in Netherlands / Holland [year]

Here is an example of the holiday allowance: on a gross salary of EUR 4.000,00 a month for a whole year, you will get a holiday allowance of EUR 3.840,00 in addition to your regular salary in May. The calculation looks like this: EUR 4.000,00 x 12 = EUR 48.000,00.

Netherlands Holidays 2019 in PDF, Word and Excel

Holiday allowance - "Vakantiegeld" in Dutch - is a mandatory payment by employers in the Netherlands, an additional amount of money on top of the employee's gross salary. As of January 2020, the standard rate is a minimum of 8% of an employee's last year gross salary. Only if an employee earns over three times the legal minimum wage, the.

Christmas Traditions and Customs from Around the World

Holiday pay is identified by law as an 8 percent remuneration paid in either the month of May or June. If a company decides to pay the vacation allowance in a month other than May or June, this allowance cannot be regarded to be your vacation allowance. The employees will still have a right to vacation allowance, next to this other allowance.

Holiday allowance around the world infographic Visualistan

Almost every employee in the Netherlands is entitled to holiday allowance, including part-time workers, temporary staff, and those on fixed-term contracts. The calculation is straightforward: if you earn €30,000 a year, your holiday allowance would be €2,400 (€30,000 * 0.08). However, there are exceptions and variations.

holiday allowance / extra vacation payment / extra vacation paymsent / holiday pay Stock Photo

By law, the minimum number of Dutch holidays to which employees are entitled each year is four times the number of working days a week. In the case of a full-time employment (pro-rated working part time), the employee is entitled to a minimum of 20 holidays per year (4 x 5 working days a week). The holiday year runs from 1 January to 31 December.

Dutch Vacation Law Holiday Allowance [2021 Guide]

Dutch Holiday allowance is a mandatory payment by employers of an extra wage to their employees. As of January 2020, the standard rate is a minimum of 8% of your total wage or 8.33% for temporary workers. READ MORE: Wages in the Netherlands: the 2020 guide to Dutch salaries. A Collective Bargaining Agreement (CAO) is operated by most work.

Holiday allowance and vacation days in the Netherlands

Holiday allowance is an allowance that employees in the Netherlands receive from their employer to cover extra costs for holidays. Outside the Netherlands, holiday allowance is an unknown concept. Of course, it is not mandatory to spend the allowance on a holiday, but that was originally the intention, since the Dutch government wants employees to be able to go on holiday.

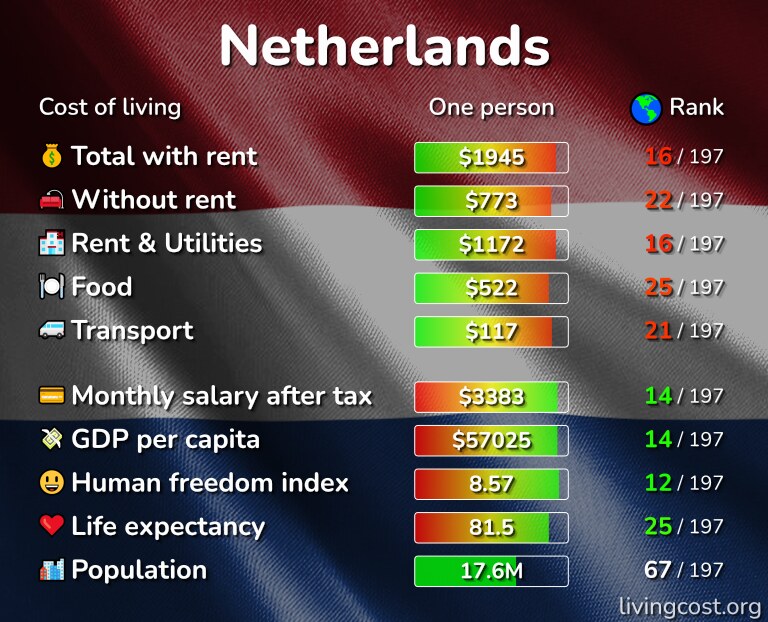

Cost of Living in the Netherlands 70 cities compared [2024]

The holiday allowance is a gross payment of a minimum of 8% of your gross salary built up during your employment over the period June - May (the most common build-up period), and it is mandatory that employers pay it. The holiday allowance was introduced in the 1920s, and it was meant to be a kind of paid leave.

How to apply & get house rent allowance in Netherlands 🇳🇱 as expats? YouTube

How to calculate holiday allowance for an employee. As a rule of thumb, the holiday allowance amounts to 8% of an employees' yearly gross salary. So if an employee earns around €50.000, - euro's gross per year, you can expect to receive an estimation of €4000, - euro's gross (before taxes) per full year worked. The calculation is.

Holiday allowance and vacation days in the Netherlands TOSS in Holland

Holiday allowance in the Netherlands. In most cases, your holiday allowance is calculated over the gross annual salary, i.e. the gross salary you earned during the past year. In case of illness and pregnancy the accumulation of your holiday allowance continues. Payments such as profit sharing and year-end bonuses do not, in most cases, count.

Netherlands Holidays 2019 in PDF, Word and Excel

Holiday allowance is a mandatory financial benefit in the Netherlands. Introduced to encourage workers to take vacations, it constitutes an additional payment on top of the employee's salary. This allowance typically amounts to 8% of the employee's gross annual salary.

- We Zijn Er Bijna 2023

- So It Goes Billy Joel

- It Is Well With My Soul Hymn Story

- Waarom Wordt De Tijd Verzet

- Wat Betekent De Naam David

- вечер с владимиром соловьёвым сегодня

- How To Do A Kolmogorov Smirnov Test In Spss

- Wonen Er Mensen Op De Zuidpool

- T Wapen Van Haarzuylen Brink Utrecht

- Bernard Cornwell Last Kingdom Books