financial derivatives lecture Series 1 options contracts explained options concept YouTube

Options, Futures and Other Derivatives. John Hull. Pearson/Prentice Hall, 2009 - Business & Economics - 822 pages. Updated and revised to reflect the most current information, this introduction to futures and options markets is ideal for those with a limited background in mathematics. Based on Hull's Options, Futures and Other Derivatives, one.

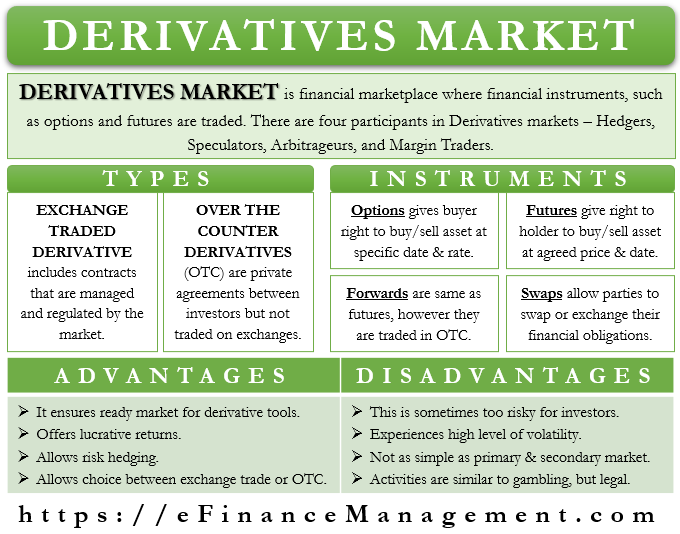

Derivatives Market Types, Features, Participants and More

This portfolio provides an average risk-adjusted hedge return of 0.34% in the week following the formation date (19.3% annualized). If option volume is concentrated among risky firms with higher return volatility, one might anticipate the opposite result, namely that firms with higher O/S earn higher future returns.

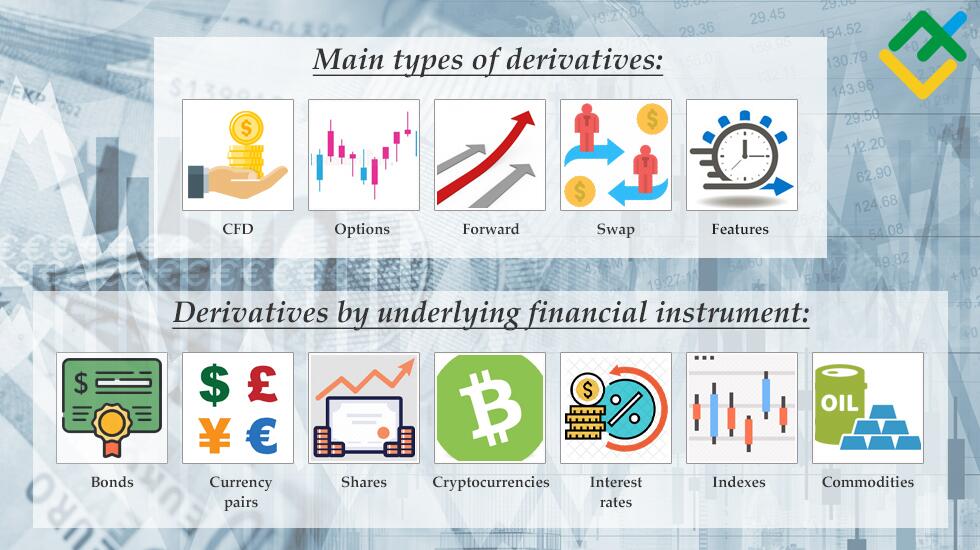

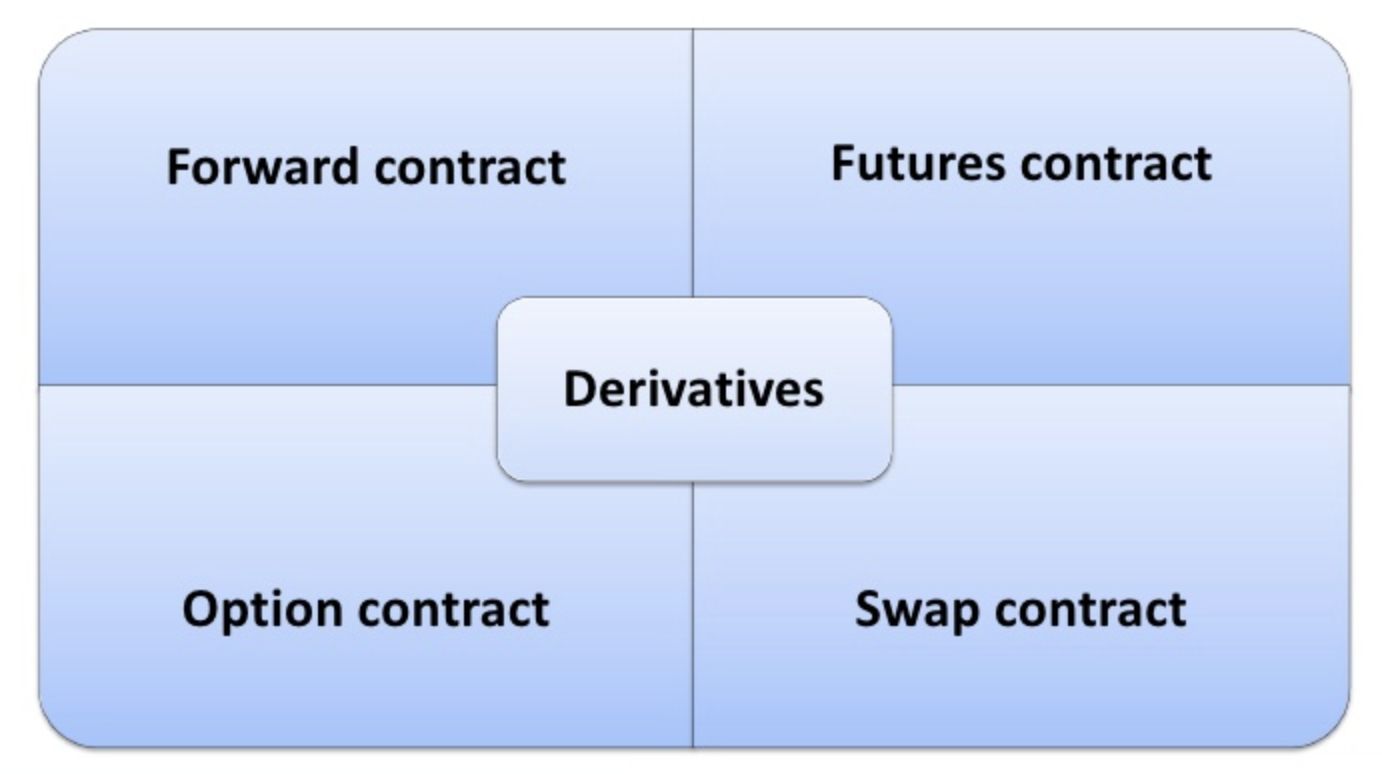

Derivatives Definition, Types Forwards, Futures, Options, Swaps, etc

Options, Futures, and Other Derivatives, 11th Edition (ISBN: 978-0136939979 and 978-1292410654) What's New in the 11th Edition?

PPT Mathematics in Finance PowerPoint Presentation, free download ID213812

Derivatives exposure. Under the rule, "derivatives exposure" is the sum of: (1) the gross notional amounts of a fund's derivatives transactions such as futures, swaps, and options; and (2) in the case of short sale borrowings, the value of any asset sold short. Funds may exclude certain currency and interest rate hedging transactions.

What Are Derivatives Overview, Types, Benefits, and Disadvantages LiteFinance

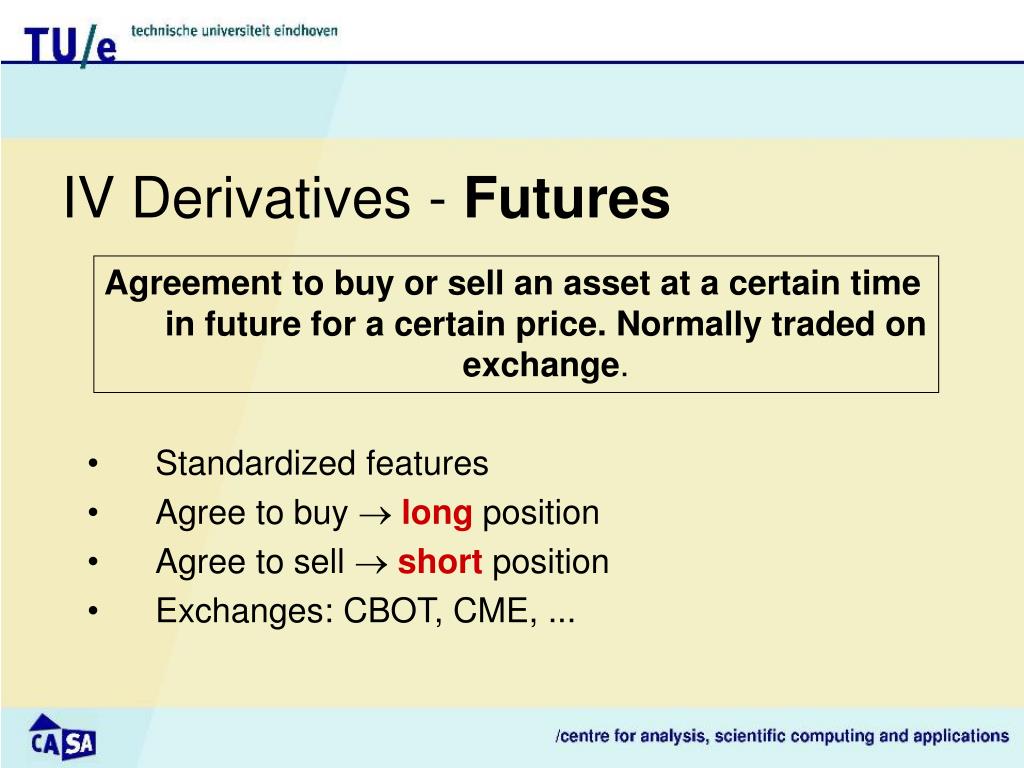

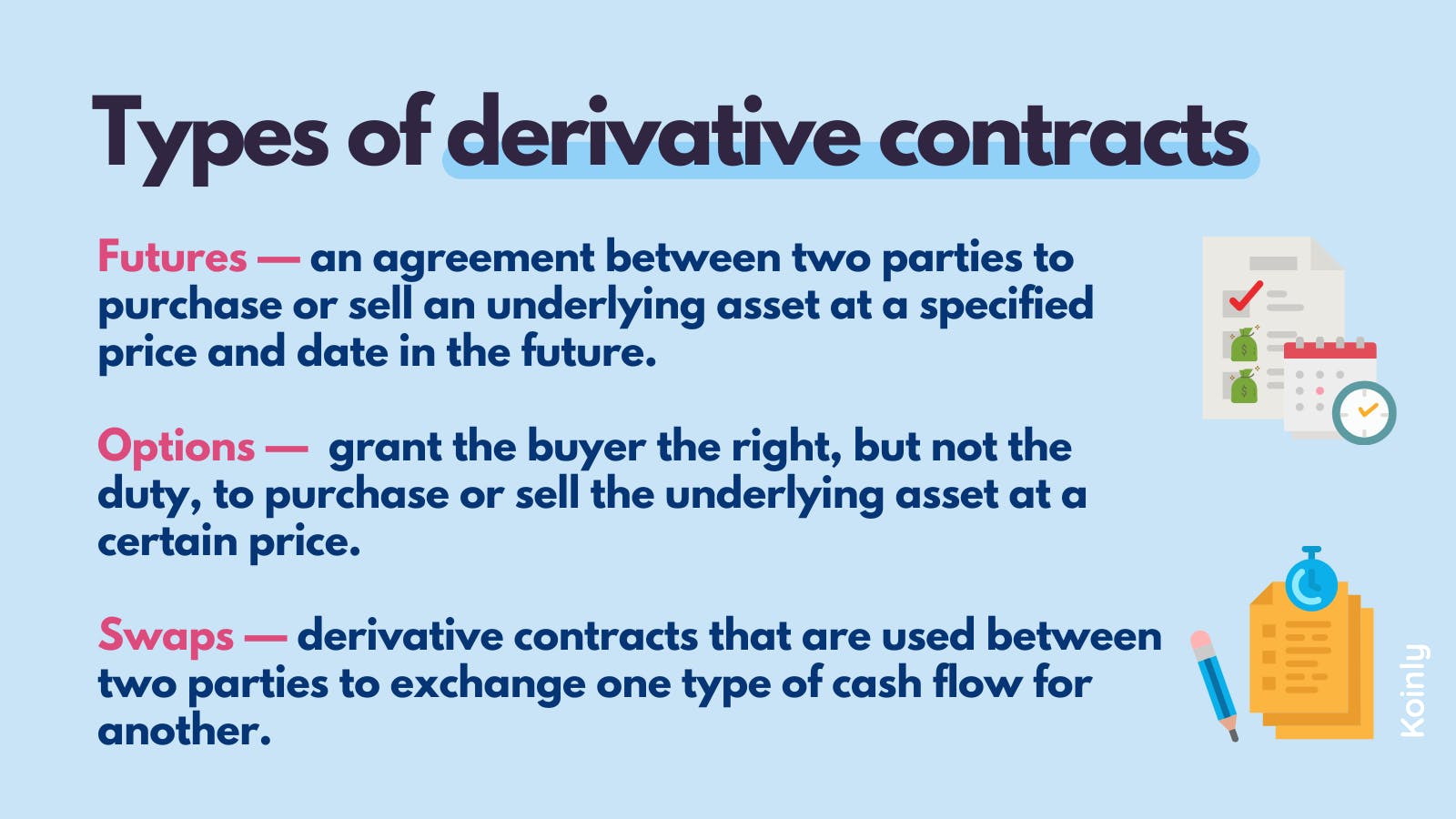

Options, swaps, futures, MBSs, CDOs, and other derivatives. Unit 10. Current economics. Economics; Finance and capital markets; Unit 9: Options, swaps, futures, MBSs, CDOs, and other derivatives. Put and call options. Learn.. Option expiration and price (Opens a modal) Forward and futures contracts. Learn. Forward contract introduction.

:max_bytes(150000):strip_icc()/derivative.finalJPEG-5c8982d646e0fb00010f11c9.jpg)

Derivatives Types, Considerations, and Pros and Cons

Options, Futures, and Other Derivatives, Global Edition. $58.46. (101) Only 10 left in stock - order soon. For courses in business, economics, and financial engineering and mathematics. The definitive guide to derivatives markets, updated with contemporary examples and discussions. Known as "the bible" to business and economics.

Financial Management Concepts in Layman's Terms

OPTIONS, FUTURES, AND OTHER DERIVATIVES John C. Hull Maple Financial Group Professor of Derivatives and Risk Management Joseph L. Rotman School of Management University of Toronto Boston Columbus Indianapolis New York San Francisco Upper Saddle River Amsterdam Cape Town Dubai London Madrid Milan Munich Paris Montreal Toronto

Types of Derivatives Market, Instruments, Contracts, Examples

Derivatives Association (ISDA) estimates that the total notional amount of caps and swaptions outstanding at the end of 1997 was over $4.9 trillion, which was more than 300 times the $15 billion notional of all Chicago Board of Trade Treasury note and bond futures options combined.

four different types of derivatives of futures, forwards, swaps and options 21014648 Vector Art

Derivatives markets have seen many changes over the last 30 years. Successive editions of Options, Futures, and Other Derivatives have managed to keep up to date. The book has an applied approach. It is a very popular college text, but it can also be found on trading-room desks throughout the world.

What Are Derivatives An Introduction IC Markets Official Blog

There are 5 modules in this course. While investing and trading in the options market may seem somewhat more daunting than other asset classes such as stocks, bonds, exchange-traded funds, currencies and commodities, you'll ultimately find that their complexity can be boiled down to simple concepts you'll be able to understand and use the.

Futures and Options Introduction to Future trading Derivative marketPart 1 YouTube

Build essential foundations around the derivatives market for your future career in finance with the definitive guide on the subject. Options, Futures, and Other Derivatives, Global Edition, 11th edition by John Hull, is an industry-leading text and consistent best-seller known as 'The Bible' to Business and Economics professionals. Ideal for students studying Business, Economics, and.

Understanding futures, options and other derivatives

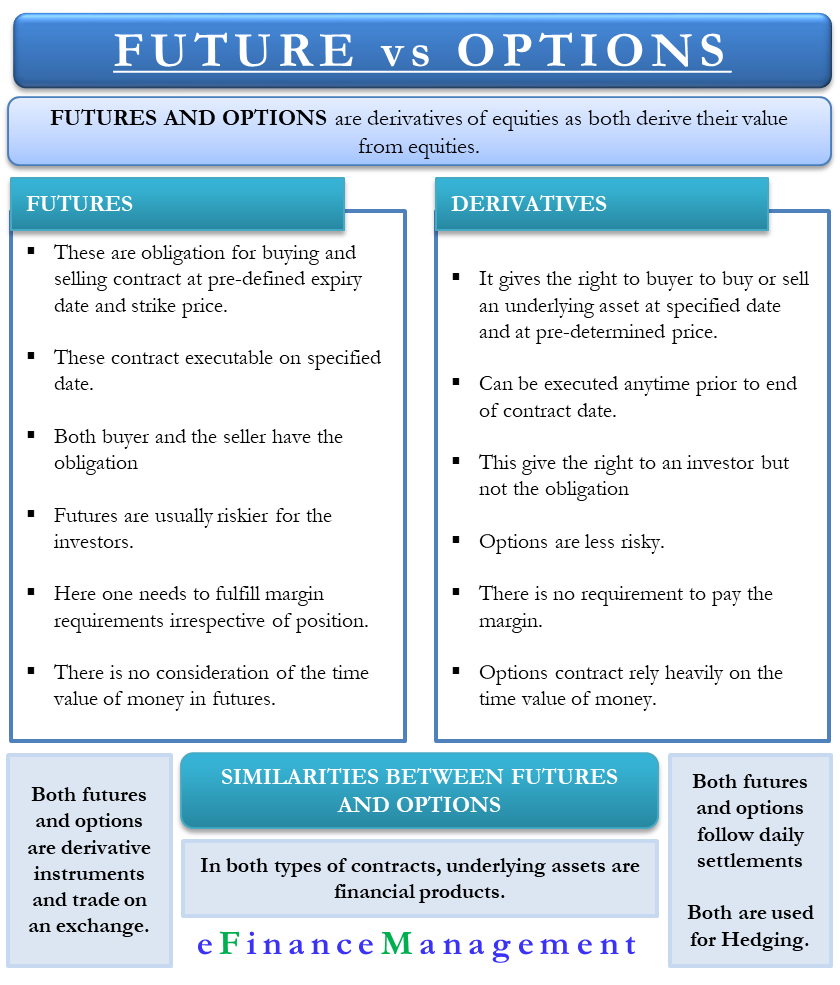

Options and futures let investors speculate on changes in the price of an underlying security, index, or commodity. However, these financial derivatives have important differences.

Understanding futures, options and other derivatives

Title: Options, Futures, and Other Derivatives, 10th Edition. Author (s): John C. Hull. Release date: January 2017. Publisher (s): Pearson. ISBN: 9780136805199. For courses in business, economics, and financial engineering and mathematics. The definitive guide to derivatives markets, updated with contemporary examples and discussions Known as.

Introduction to Derivatives Forward, Futures, Options

Options, Futures, and Other Derivatives. Published 2021. Need help? Get in touch. Explore. Schools College Work Products & Services. Pearson+ Resources by Discipline MyLab Mastering.

What Are Derivatives An Introduction Inventiva

The definitive guide to derivatives markets, updated with contemporary examples and discussions. Known as "the bible" to business and economics professionals and a consistent best-seller, Options, Futures, and Other Derivatives gives readers a modern look at derivatives markets. By incorporating the industry's hottest topics, such as the.

Options, Futures, and Other Derivatives, Global Edition von John C. Hull Taschenbuch 9781

This is a video lecture designed to follow the Power Points from Hull, Options, Futures, and other Derivatives. It is an introduction to Derivatives includi.

- Moet Je Inchecken Met Een Dagkaart

- Garmin Forerunner 55 Garmin Pay

- Chords For Dancing On My Own

- Een Zeer Laag Cijfer Op Het Slechtst Mogelijke Moment Cryptisch

- Olivia Newton John En Grease

- Ibis Style Rastatt Baden Baden

- Mtv Ex On The Beach Seizoen 9

- Casa De Mar Koh Samui

- Que Faire Au Pays Bas

- Artikel 184 Wetboek Van Strafrecht