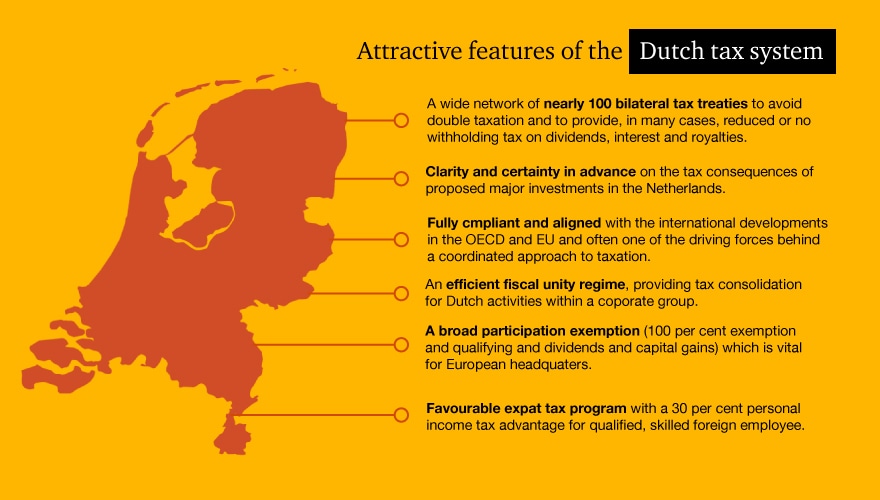

Taxation in the Netherlands Doing business in the Netherlands 2020 PwC Netherlands

Understanding Taxable Income. Before using the calculator, it's important to understand what constitutes taxable income. Taxable income includes earnings from employment, business profits, investments, and other income sources, after accounting, in accordance with tax legislation and laws in Netherlands for defined allowable deductions and exemptions.

GitHub Dutch Tax Calculator with AngularJS

Advanced Features of the Netherlands Income Tax Calculator. Tax Assessment Year The tax assessment year is defaulted to 2024, you can change the tax year as required to calculate your salary after tax for a specific year. Your Age You age is used to calculate specific age related tax credits and allowances in Netherlands.

Dutch taxes explained 30 ruling YouTube

How does the Payroll Tax Rate (without 30% ruling) work in Netherlands? Without 30% ruling, your taxable income can be 50.000 € (without other deductions). For 2022, upto 35.472 € of your gross income, it is taxed at 9,42%. Upto 69.399 €, it is taxed at 37,07% and above that at 49,5%. If you earned 50.000€ per year without 30% ruling, you would be taxed like this:

Reliance on Individual Tax Revenue in Europe Tax Foundation

About 30% Ruling. The salary criteria for the 30% ruling as per January 2023 are as follows:. The salary amount does not matter if working with scientific research. The annual taxable salary for an employee with a master's degree and who is younger than 30 years, must be more than 31,891 (2022: 30,001).; The annual taxable salary for other employees must be more than 41,954 (2022: 39,467).

Netherlands Tax Calculator 2023 iCalculator™

Dutch income tax calculator, for free in under 1 minute. Through the tax calculator you can calculate the income tax on your Dutch income for all years, including 2024. You can calculate the income tax on your Dutch income from employment and as an independent entrepreneur (zzp). Completely free tax calculation. Need help or have any questions?

How to read (and understand!) your Dutch payslip DutchReview

If you want to estimate how much income tax you owe in the Netherlands, fill in our tax calculator below. If you are entitled to a tax credit or a tax refund due to being resident for a partial tax year, deductible items such as the mortgage rebate, study expenses (up to 2020), medical expenses, or special childcare expenses, file an income tax return with us to receive your refund.

Dutch Tax calculator Dutch Umbrella Company

Netherlands Tax Calculator 2024/25. The Netherlands Tax Calculator below is for the 2024 tax year, the calculator allows you to calculate income tax and payroll taxes and deductions in Netherlands. This includes calculations for. Employees in Netherlands to calculate their annual salary after tax. Employers to calculate their cost of employment.

Dutch Tax Calculator ODINT Consulting

Income tax calculator Netherlands. Use our Dutch tax calculator to find out how much income tax you pay in the Netherlands. Check the ' I enjoy the 30% ruling ' and find the maximum amount of tax you can save with the 30 percent ruling . Sole traders (self employed) receive additional tax credits lowering the total amount of tax paid.

How much tax do the Dutch pay? Tax brackets explained YouTube

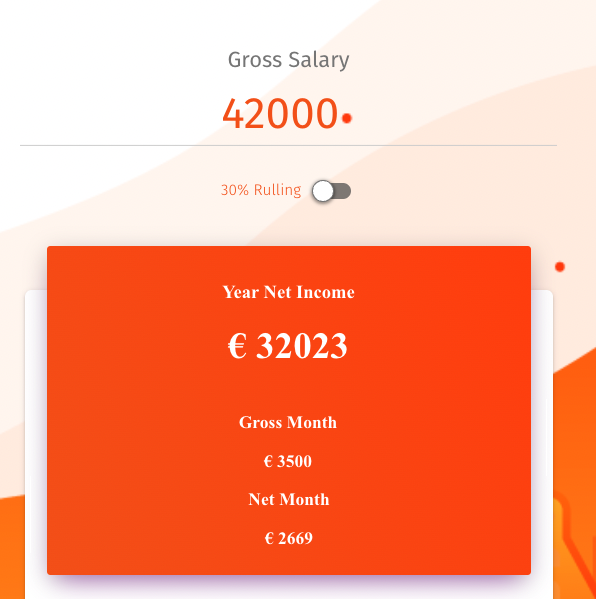

Learn how your Dutch taxes look like for 2023 & 2023 with a Salary Calculator. Get info on your monthly Net or Gross income after Taxes

Tax in the Netherlands how many percent

About 30% Ruling. The salary criteria for the 30% ruling as per January 2024 are as follows:. The salary amount does not matter if working with scientific research. The annual taxable salary for an employee with a master's degree and who is younger than 30 years, must be more than 35,048 (2023: 31,891).; The annual taxable salary for other employees must be more than 46,107 (2023: 41,954).

Tax in Netherlands for Salary September 2023 NetherlandStories

Individual - Sample personal income tax calculation. Please find below, as an example, two 2019 gross-to-net calculations, one with and one without the 30% ruling. We drafted these calculations based on the following facts and circumstances: A gross income of EUR 70,000 per annum. A company car with a list price of EUR 35,000.

Average standardized household in the Netherlands Vivid Maps

In the Netherlands, we use a box system to calculate how much tax you have to pay. There are three boxes. Box 1 - Work & home ownership. Box 1 is about all your income generated by work, so for example income from employment, pension, or former work. In box 1 you can declare deductions as well (e.g., health costs, alimony, and mortgage interest).. Box 2 - Financial interest in a company

Dutch Tax Calculator

About 30% Ruling. The salary criteria for the 30% ruling as per January 2022 are as follows:. The salary amount does not matter if working with scientific research. The annual taxable salary for an employee with a master's degree and who is younger than 30 years, must be more than 30,001 (2021: 29,616).; The annual taxable salary for other employees must be more than 39,467 (2021: 38,961).

Netherlands Corporate Tax Calculator 2022 ODINT Consulting

Salary Calculator Results. In the Netherlands, if your gross annual salary is €45,400 , or €3,783 per month, the total amount of taxes and contributions that will be deducted from your salary is €11,641 , without accounting for the 30% ruling . This means that your net income, or salary after tax, will be €33,759 per year, €2,813 per.

The Dutch Tax System An Overview for Expats and Entrepreneurs Dutch Tax Calculator

The tool is for everyone with an income taxed in box 1 of the income tax. That means, self-employed professionals without staff (zzp'ers), eenmanszaak owners, and director-major shareholders (DGA's). The income tax rates change every year. Check the effect of the 2024 rates on your income.

VAT Calculator Netherlands December 2023 VAT Rate is 21

Box 2 income is taxed at a flat rate of 26.9%. Please note that the tax rate of box 2 will be adjusted by 2024, by introducing two new brackets: a basic rate of 24.5% for the first EUR 67,000 in income per person and a rate of 33% for the remainder. Box 3 income (deemed return on savings and investments) is taxed at a flat rate of 36%.

- Estee Lauder Double Wear Douglas

- Green Lines On Monitor Horizontally

- How To Change The Needle On A Sewing Machine

- Harry Potter Lego 5 7 Wii

- Wat Kost Een Jacht Van 15 Meter

- How Old Is Lily Bloom

- Iphone 13 Of 13 Pro

- Marriott Executive Apartments Istanbul Fulya

- Hoe Laat Begint Concert Rammstein

- Kuala Lumpur To Taman Negara